海外之声 | IMF:亚洲经济在关税冲突与不确定性中保持韧性

导读

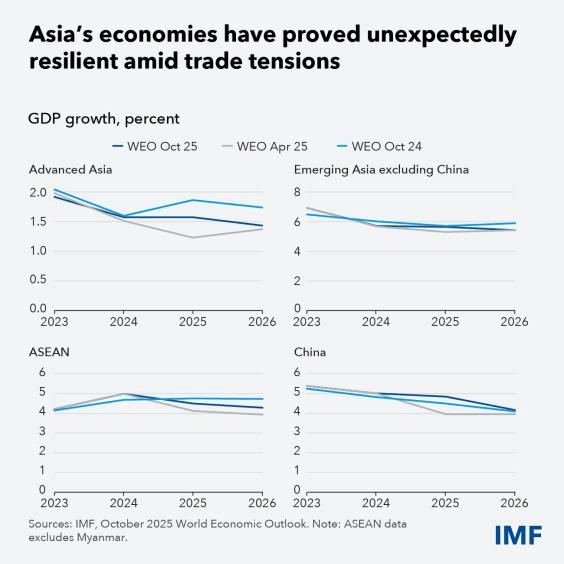

2025年10月16日,IMF亚太部发布《亚洲经济增长在关税与不确定性下保持韧性》。最新预测显示,2025年亚洲及太平洋地区经济增速将从今年的4.5%小幅放缓至4.1%,通胀预计整体维持温和水平。中国增速将由4.8%降至4.2%,日本由1.1%降至0.6%;印度今年以6.6%的增速在主要新兴经济体中居前,明年略降至6.2%;韩国将由0.9%回升至1.8%;东盟经济体今年和明年均保持4.3%的增速。在全球贸易政策重置的中心,亚洲今年和明年仍将贡献约60%的全球增长。

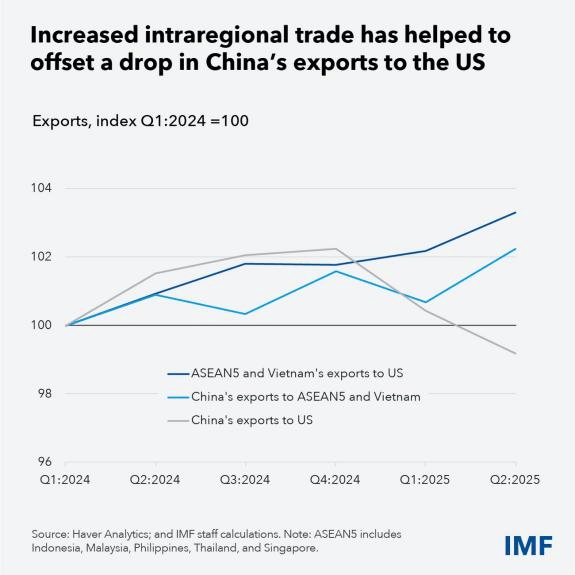

亚洲的韧性来自多重因素叠加。美国在今年4月将有效关税提高到数十年来的高位,即便在随后出现暂停、达成协议或重新实施等变化后,关税水平仍保持高位。出口商在新关税落地前加快出货,推动一季度出口激增,之后增速回落。借鉴2018年关税措施的经验,生产与采购正向区域内部调整,中间品更多流向并经由东南亚等新枢纽,带来区域贸易的再配置。与此并行,一轮由人工智能驱动的周期正在形成,韩国、日本等经济体高端技术产品出口显著增加,强化了亚洲内部贸易联系。多国货币政策转向宽松,中国、韩国、印度尼西亚和越南等实施了定向财政支持,在美元走弱、信用利差收窄、股市估值上升以及新兴经济体国债收益率下行等因素带动下,区域金融条件整体放松,从而支撑了经济增长并缓冲外部需求冲击。

韧性背后,多重风险和结构性问题同时浮现。前景面临的下行因素包括关税进一步升级、为防范转运而加严原产地规则、供应链新一轮扰动以及全球金融环境趋紧。更深层次看,传统增长引擎减弱,与贸易环境不确定性相互叠加。部分主要经济体的人口老龄化削弱了人口红利;生产率增速放缓,与投资未能流向最具活力的企业有关;疫后“伤痕效应”仍压制国内需求,尤其是在新兴亚洲,使外部失衡进一步扩大。近期的不安局势表明,就业岗位和发展机会的不足正在加剧社会紧张,特别是在制度较为薄弱、腐败感知普遍的经济体。

当前,政策任务是把短期韧性转化为更强劲、持久且包容的增长,实现增长动力的再平衡。未来数月,政策重点在于吸收近期冲击、降低政策不确定性;在许多经济体通胀低于目标的前提下,审慎、有节制的货币宽松仍属适当,更高的汇率灵活性有助于吸收外部冲击,外汇干预应限于应对市场无序波动,并与IMF综合政策框架相一致。临时性、针对性的财政措施可用于保护最脆弱群体和支持可行企业,同时通过简化规制、改善营商环境等“横向改革”,更好发挥私营部门的增长作用。向中长期看,再平衡的核心在于既保障增长的可持续性,又提高私人消费在经济中的比重。为此,需要强化社会安全网,减少家庭出于预防性动机的高储蓄倾向,并适度收缩产业政策,防止资源过度集中。在中国,房地产市场仍承压,通过修复资产负债表、完成预售住房交付,有助于恢复住房市场信心,并最终提振私人消费。各经济体还需修复公共财政状况,在不推高私人部门融资成本的前提下,为应对未来冲击保留缓冲,同时满足关键支出需求。

资本能否流向最具生产率的用途,是再平衡能否成功的关键一环。部分经济体中,监管障碍和高负债水平压制了投资和生产率表现,通过拓宽市场化融资渠道、深化股票和债券市场、帮助借款人重组债务,可以改善资本在企业和行业之间的配置,支持具有可行性的企业发展。尽管亚洲整体开放度较高,但并不均衡,例如南亚服务业相对封闭。进一步深化区域一体化,有助于提高竞争和生产率、降低成本并分散市场风险:降低非关税壁垒,推动贸易协定更充分反映服务贸易和数字贸易的重要性,放宽对外国直接投资的限制,使之与正在进行的供应链重组相互补充。总体来看,要在贸易政策重置和多重逆风之下保持增长的持久性和包容性,亚洲经济体需要更多依托国内需求,巩固中期财政框架,并进一步深化区域贸易和金融一体化。

英文原文(节选):

Asia’s Economic Growth Is Weathering Tariffs and Uncertainty

Andrea Pescatori, Krishna Srinivasan

Asia’s economic growth next year is poised to hold up more than previously estimated despite weaker external demand, elevated tariffs, and persistent policy uncertainty. Growth in the Asia and Pacific region is likely to slow to 4.1 percent next year from 4.5 percent this year, our latest projections show. Inflation is likely to remain moderate.

China’s economic growth is forecast to slow from 4.8 percent this year to 4.2 percent next year, while Japan’s decelerates from 1.1 percent to 0.6 percent. India will still expand at a healthy pace of 6.6 percent this year, the most among major emerging economies, while slowing to 6.2 percent next year. Korea’s growth will accelerate from 0.9 percent this year to 1.8 percent. The Association of Southeast Asian Nations (ASEAN) economies will expand by 4.3 percent for a second straight year.

While Asia is at the center of the global trade-policy reset, it will remain the biggest driver of global growth, contributing about 60 percent this year and next. The shock from trade tensions has been cushioned by a front-loading of exports ahead of new levies, stronger-than-expected investment in artificial intelligence, ongoing supply-chain reconfiguration within the region, and policy easing in some countries.

But several risks to the outlook underlie this resilience. They include renewed escalation of tariffs and more rules-of-origin restrictions to avoid transshipments, further supply-chain disruptions, and tighter global financial conditions. Trade remains a key part of the resilience narrative. The United States in April raised effective tariff rates to multi-decade highs, and they remain high even after various pauses, agreements, and reinstatements. Exporters accelerated shipments ahead of implementation, contributing to a first-quarter surge that cooled in the following three months.

Beyond the near-term resilience, a weakening in historical growth engines is compounding the effects of the uncertain trade environment. Aging is diminishing the demographic dividend in some major economies. Productivity growth is slowing because investment isn’t always reaching the most dynamic firms. In addition, with post-pandemic scarring still weighing on domestic demand, especially in emerging Asia, external imbalances have widened. Moreover, recent unrest underscores how a lack of jobs and other opportunities are fueling social strains, particularly where institutions are weaker and perceptions of corruption are widespread.

Rebalancing growth

The task for policymakers is to convert today’s resilience into strong, durable and inclusive growth that harnesses new drivers to better realize economic potential.

In coming months, policies should focus on absorbing recent shocks and lowering policy uncertainty. With inflation below target in many economies, measured monetary easing remains appropriate. Exchange-rate flexibility should help absorb shocks, with intervention reserved for disorderly conditions, in line with the IMF’s Integrated Policy Framework. Temporary, targeted fiscal measures can protect the most vulnerable people and support viable businesses. In addition, horizontal reform policies, including a concerted streamlining of regulations and improving the business environment, will be essential to unleashing the role of the private sector.

In coming years, policies should prioritize securing durable growth and expanding the share of private consumption in the economy. Successful rebalancing can be achieved by strengthening social safety nets so that people don’t feel obligated to save precautionarily. It will also be important to scale back industrial policies. And in China, where property markets remain strained, repairing balance sheets and completing pre-sold homes can help restore confidence in housing markets and ultimately boost private consumption.

Capital must flow to its most productive uses. Regulatory obstacles and high borrowing have weighed on investment and productivity in parts of the region, our analysis shows. Reforms to broaden market-based finance, deepen stock and bond markets, and help borrowers restructure debt will better allocate capital and help viable enterprises grow. Although Asia’s economies are relatively open, that’s not uniformly the case. South Asia’s services industries, for example, are relatively closed. Our analysis shows that deeper regional integration would increase competition and productivity, cut costs, and diversify markets. Lowering non-tariff barriers, expanding trade agreements to reflect the growing role of services and digital trade, and easing restrictions on foreign direct investment would attract investment and complement the ongoing reconfiguration of supply chains.