AI Overseas Commercialization: Manus Finds New Partners to Solve the Puzzle

By Wang Lu

In August this year, Peak Ji, co-founder and Chief Scientist of Manus, announced at the Stripe Tour in Singapore that Manus had reached an annualized recurring revenue (Revenue Run Rate) of $90 million.

From making a splash on overseas social platforms in March 2025 to achieving nearly $100 million in revenue within just four months, Manus’ meteoric rise has once again ignited excitement in the AI startup community, bolstering the confidence of AI application entrepreneurs.

However, not every AI company finds such success. Many AI products that have made it onto the Product Hunt leaderboard struggle to effectively commercialize. For these companies, the exposure from the leaderboard ends up being of little practical value for growth.

Resource-constrained founders have to not only keep pace with rapid developments in AI and create breakthrough products, but also devise sound monetization strategies to convert users into paying customers. Turning viral traffic into commercial success has become a key challenge for AI entrepreneurs moving to the next stage.

Even more crucially, the inherently "born global" nature of AI applications tests founders’ abilities and experience in going international. For entrepreneurs just beginning their global journey, in addition to AI innovation, finding a partner with robust global infrastructure to accelerate product globalization is absolutely essential.

Manus’s Explosive Overseas Growth: Stripe as the Key Enabler

The collaboration between Manus and Stripe offers valuable lessons for other AI founders.

In March 2025, startup Butterfly Effect launched the world’s first general-purpose AI Agent product, Manus, along with a demonstration video, on the international social platform X. The intelligence on display in the video instantly wowed the public, sparking a global sensation around Manus.

Within just one month of launch, Manus attracted users from over 200 countries and regions. In four months, it achieved an annualized revenue of $90 million.

Such remarkable results were only possible because the Manus team had learned important lessons from their previous entrepreneurial “missteps.”

Before Manus, inspired by large language model technologies, Xiao Hong, Ji, Zhang Tao, and other members of Butterfly Effect developed Monica—an AI browser extension targeting overseas markets—in 2022. This product also achieved impressive results, attracting over 20 million users worldwide. However, its path to commercialization was not smooth, especially in the early stages.

As a startup, Butterfly Effect had limited scale and resources and needed to concentrate its technical capabilities on product development, leaving areas like payments to third-party technology service providers. Since most paying users were based in North America while the team operated from China, this time zone difference meant Monica’s support tickets often went unresolved for days, severely impacting user experience and hindering commercialization efforts.

After launching Manus, the team aimed to avoid getting “choked at the payment” bottleneck again. Moreover, Manus, as an AI Agent, offers much more diverse services than Monica, resulting in a more complex paid subion strategy. Choosing a reliable global payment partner became crucial for Manus.

Learning that AI companies like OpenAI and Perplexity had partnered with Stripe for payment processing, Manus also chose Stripe as its new payment partner.

Manus first implemented Stripe’s Checkout Optimization Suite, launching payment methods such as credit cards, Apple Pay, Google Pay, Alipay, and Link (Stripe’s digital wallet), to meet the needs of different users. This enabled Manus to support transactions for users in over 200 countries and regions, accelerating its globalization.

Zhang Tao, co-founder and Chief Product Officer of Manus, told TMTPost Reference, “Stripe’s built-in global payment functions saved the Manus team months of work. The complete solution allowed Manus to scale globally from day one, without the need to build separate payment infrastructure for each market.”

At the same time, Stripe’s Checkout Optimization Suite can automatically display prices in local currencies and handle exchange rates—covering 31 currencies, including GBP, USD, JPY, AUD, EUR, and SAR. This level of localization undoubtedly improved local user sentiment and, in turn, boosted payment conversion rates.

Leveraging Stripe’s global infrastructure, Manus solved the “last mile”of payments for users worldwide in just one month, ensuring user retention and commercial conversion during the peak of product popularity. This paved the way for its legendary surge to an annualized revenue of $90 million in just four months.

It’s worth noting that during its rapid business expansion, Manus encountered payment fraud issues. By implementing Stripe Radar’s AI-powered fraud detection technology, Manus was able to efficiently prevent card verification fraud and other types of attacks. At the same time, Manus relies on Stripe Tax to handle cross-border tax compliance in over 200 countries, effectively avoiding overseas tax compliance challenges.

According to Zhang, co-founder and Chief Product Officer of Manus, "From day one, Stripe has supported our commercial monetization with its outstanding technology and deep understanding of our needs. Stripe is not just a vendor but a strategic partner during our critical growth phase."

The success of Manus is certainly encouraging; however, recent research conducted by Stripe reveals that innovative AI applications are facing significant commercialization challenges.

AI Monetization Faces Four Key Challenges: Adjusting Monetization Strategies and Adopting Compound Pricing Have Become the New Norm

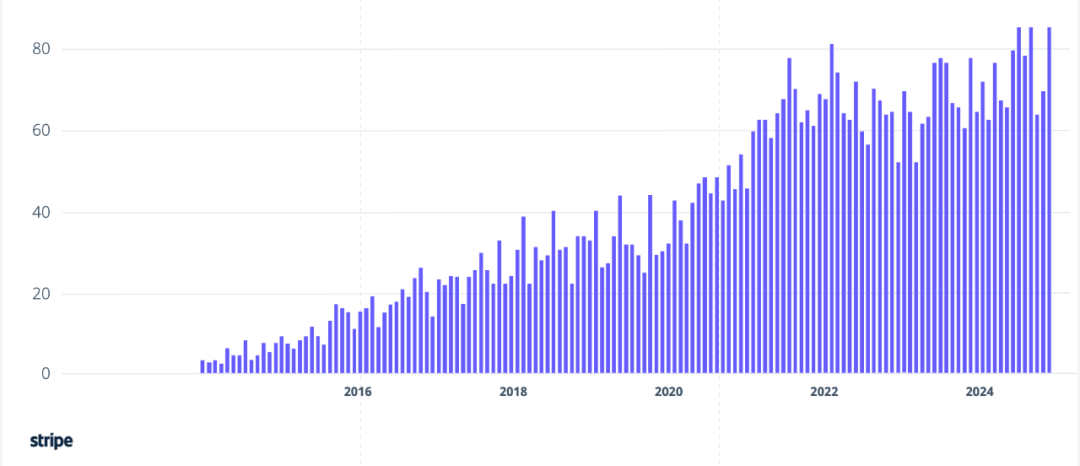

Over the past decade, the number of companies growing their ARR (Annual Recurring Revenue) from $1 million to $10 million has increased month by month. This growth rate has accelerated even further since the advent of large language models, outpacing any previous technology wave. In the “every day feels like a year” AI industry, developing a sound commercialization strategy has become crucial for sustained growth.

Recently, Stripe surveyed over 2,000 AI and SaaS companies worldwide. The data shows that faster-growing AI companies tend to adjust their monetization and pricing strategies more frequently, and compound pricing models have become the new normal in the AI era.

Many AI unicorns have adopted this kind of pricing model, including Manus. Manus’s commercial pricing structure is divided into four tiers: Free, Pro, Team, and Enterprise, with Credits as the core unit of measurement.

New users on the Free plan receive a one-time reward of 1,000 credits and a daily bonus of 300 credits, enabling them to experience basic Agent services such as writing short articles and generating simple illustrations.

The Pro plan offers four paid options, with both monthly and annual subion packages available. Credits are granted according to the subion fee, which can be used for a range of tasks such as data analysis and PPT generation, varying in workload and output capability.

Additionally, Manus is testing the Team pricing plan, which charges based on the number of seats, starting at 2 seats. Each seat is priced at $40 per month, with an alternative of $400 per year per seat.

However, this was not the original pricing when Manus first launched. In March of this year, Manus offered just two paid plans: Starter at $39 per month and Pro at $199 per month, with services different from those currently available.

This aligns with Stripe’s research findings. In the past, traditional SaaS companies typically relied on a single subion billing model, pricing by the number of seats and with fixed rates. However, this pricing model is difficult to maintain for AI applications. This reflects four major challenges and realities faced by the AI industry.

First, high-usage users eat into profit margins. Usually, a few super users consume most of the compute resources, making it unsustainable to use a fixed-rate pricing model when such users scale up their usage.

Second, token-based billing confuses users. Most regular internet users want simple and predictable pricing; billing based on token consumption forces them to think like cloud computing architects, making it more complicated and generating anxiety over costs.